By Adam Pagnucco.

Part One examined Superintendent Thomas Taylor’s rationale for his huge capital budget ask. Part Two quantified huge in historical terms. Part Three looked at the details of Taylor’s budget. Part Four began an examination of how to pay for it, starting with general obligation (G.O.) bonds and state aid.

Let’s continue looking at the remaining three revenue sources used by the county for school construction.

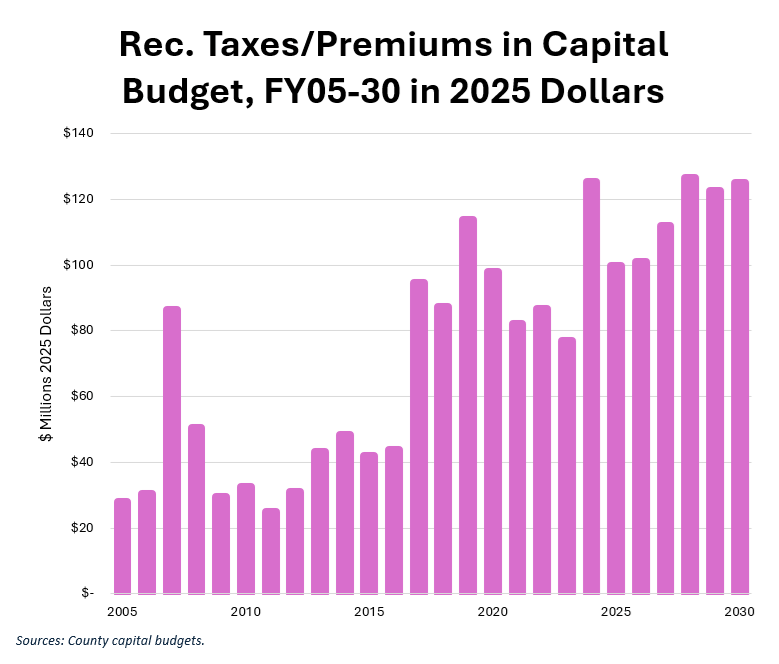

Recordation Taxes and Recordation Tax Premiums

33% of MCPS’s FY25-30 capital budget

Maryland counties (including Baltimore City) levy recordation taxes on real estate transactions. The taxes are usually expressed as a dollar amount per $500 of transaction value. In FY25, rates varied from a low of $2.50 in Baltimore and Howard counties to $7.00 in Frederick County.

MoCo is an outlier. Under a law authored by Council Member Kristin Mink, MoCo’s recordation tax has separate components for a base rate and a school increment, the latter dedicated to MCPS. Transactions of greater than $500,000 have premiums applied that rise with transaction tier. The math is incredibly complicated, but high-value properties can exceed what Frederick charges. That gives us the distinction of having both the most complex and potentially the most expensive recordation taxes in Maryland.

Recordation taxes and their associated premiums have two things going for them as a revenue source. First, major tax hikes authored by Mink starting in FY24 (above) and former Council Member Nancy Floreen (starting in FY17) have produced rate spikes. Second, soaring property values have triggered recordation tax premiums, which dramatically increase tax payments.

The chart below shows annual use of recordation taxes and premiums in the capital budget in real 2025 dollars. (See Part Two for the methodology of this chart’s construction.)

There is no question that the Floreen and Mink tax hikes have yielded much more money over the years, but there are some caveats. First, this revenue source is sensitive to recessions and we could be heading into one. Second, the median home sale price in MoCo was almost $600,000 in September, triggering the recordation tax premium for most buyers and making home affordability progressively worse. Third, rent control has clobbered apartment building transactions, which should affect recordation tax collections. And fourth, the county just raised this tax two and a half years ago. Will it do so again so soon?

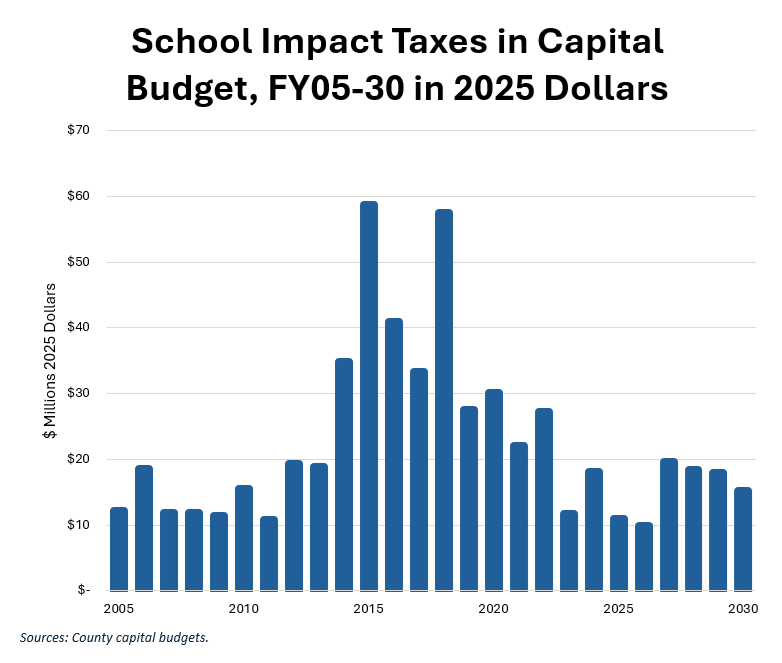

School Impact Taxes

6% of MCPS’s FY25-30 capital budget

The county has long charged a school impact tax on new residential units to finance school construction. The county has occasionally raised this tax over the years and did it again in 2023, although it could have been much worse.

The school impact tax is extremely volatile. It’s sensitive to recessions (like recordation taxes) because it depends on new development and it’s really hard to estimate, especially in out years. Back in the FY15-20 amended CIP, it accounted for 14.7% of MCPS’s capital budget. It’s now down to 5.6% of MCPS’s capital budget, the lowest percentage since the Great Recession.

The chart below shows annual use of school impact taxes in the capital budget in real 2025 dollars. (Again, see Part Two for the methodology of this chart’s construction.)

This chart is frankly amazing. Yes, I wrote about how a collapse in impact taxes had tanked the capital budget back in January, but I did not adjust the data for inflation as I did above. Accounting for inflation, the estimates for school impact taxes in FY25 and FY26 are about as low as they were during the worst years of the Great Recession.

We’re not in a recession now. But we could be within months. How much worse could this get?

Also, when the above revenue estimates were made, the evaporation of multi-family building permits due to rent control was not yet known. What happens when that is included in the next round of estimates? Is it possible to have negative school impact tax receipts?

You can’t get blood from a stone, and you can’t collect money from development if there is no development.

Current Revenues (Cash)

10% of MCPS’s FY25-30 capital budget

This section is going to be short, folks. In the most recent capital budget, MCPS received $25-30 million a year in cash. If that amount is going to go up by several multiples – which it must in order to make a dent in funding Taylor’s recommendation – it will almost certainly have to come from a property and/or income tax increase or some form of restraint on employee compensation growth. And since cash comes from the operating budget, if more of it goes to MCPS’s school construction projects, less of it will be available to fund what will almost certainly be a substantial operating request from Taylor.

Looming over all of this is the federal shutdown, which could be a substantial threat to county income tax receipts. That would be especially true if President Donald Trump follows through on his threats to lay off federal workers and/or withhold back pay they would normally get after the shutdown ends.

And so the county’s revenue sources for school construction are either flat (general obligation bonds and state aid), volatile (recordation taxes), in a state of collapse (impact taxes) or in direct competition with the operating budget (cash). In addition, nearly 40% of funding for school construction is dependent on the real estate industry, which is being ravaged by rent control.

It will be an interesting budget season, especially during an election year.