By Adam Pagnucco.

Coming out of the pandemic, the county is confronting economic headwinds including inflation and potential recession. It has vulnerable populations with needs, issues with recruiting and retaining employees in a tight labor market, schools requiring more investment and an affordable housing shortage. And it has limited resources to deal with all of those challenges.

That’s a fair description of Montgomery County. But it also applies to every other jurisdiction in the region. Our county executive has chosen to recommend a 10% property tax hike to deal with these problems and two council members – Kristin Mink and Will Jawando – have proposed additional tax increases. What is everyone else in the region doing?

Most local jurisdictions have published FY24 budgets. The District of Columbia, Baltimore City, Calvert, Charles, Frederick, Harford, Howard, Prince George’s, Alexandria, Arlington, Fairfax and Prince William have proposed FY24 budgets at this writing. Baltimore County and Loudoun have adopted FY24 budgets. Anne Arundel County has not published its proposed FY24 budget yet.

None of these jurisdictions have proposed to increase property tax rates. Three jurisdictions – D.C., Baltimore City and Frederick – have proposed or adopted rate increases to other taxes. D.C. increased its tax on gross receipts of transient accommodations by one percent in February. Baltimore City automatically adjusts its energy tax rates with its local CPI. I wonder if Baltimore residents and businesses are aware of this.

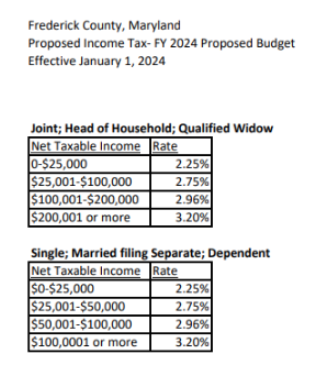

Frederick may be changing its income tax rate structure. Frederick once had a flat income tax rate of 2.96%. Last year, the county adopted a 2.75% bracket for single filers making $50,000 or less and joint filers making $100,000 or less while those making more money would pay 2.96%. This year, County Executive Jessica Fitzwater has proposed establishing a new bracket of 2.25% for those earning less than $25,000 per year while raising the top rate to 3.2%. The county’s budget office sent me the table below showing the executive’s proposed brackets.

So under the proposal, some Frederick residents would get a tax cut, others would get a tax hike and others would net out at a similar level. The budget estimates that income tax collections will rise by $45 million in FY24 but it’s unclear how much of the increase comes from a growing tax base and how much would come from changes in the rates. We shall see what the Frederick County Council chooses to do.

Just because these jurisdictions are not raising property tax rates does not mean that they are not getting more property tax revenues. As a matter of fact, most of them are reporting substantial added revenues because of increases in assessments. They are using these extra revenues to increase their overall spending with much of it going to schools. One exception is D.C., where real property tax collections are projected to be flat because of problems in its downtown. D.C. could have reacted by raising its real property tax rates but it did not.

Two jurisdictions are cutting real property tax rates. Loudoun is cutting its rate by one and a half cents. That is in addition to a five cent cut in its personal property tax rate. Despite these rate cuts, the county expects residents to pay an average real property tax bill increase of $339 due to rising assessments. Prince William is also cutting its real property tax rate. Its county executive (an appointed official) commented, “The proposed budget mitigates rising residential real estate assessed values by reducing the real estate tax rate from $1.03 to $0.977 per $100 of assessed value. The average residential tax bill increases 1.0% or $49 at the proposed real estate tax rate over the previous year.”

Many jurisdictions are raising fees. Fairfax is increasing its emergency medical services fee which it expects to raise $2 million. (The county has an all-funds budget of $10 billion.) The county is also raising its refuse collection and sewer fees. Prince William is increasing its solid waste management fee for the first time since 1998 with households expected to pay an extra $70-75 a year. Arlington is raising fees on solid waste, top soil, recreation services, police services and development reviews. Frederick is raising its 911 fee.

It’s important to remember a key distinction between D.C. and Maryland vs Virginia. In D.C. and large Maryland jurisdictions, elected officials (the mayor or county executive) propose budgets. In Virginia, appointed managers propose budgets. There is a big difference between having politicians draft budgets and having public sector professional managers propose them. The latter are not pandering to special interests to run for reelection, so they may be less likely to jam their budgets full of goodies. That’s the job of politicians, but if the ones in Virginia want to hand out candy, they have to cut spending or add revenues to their managers’ budgets to pay for it.

One interesting model is Alexandria, where the city manager did not include tax hikes in his budget but included optional incremental increases for consideration by the city council. For each tax the city has, the administrator lays out how much money an increase would raise and leaves it to the city council to decide whether to raise it. The council also told the administrator to prepare an alternate budget scenario with a one-cent property tax rate increase so they could see what it would look like. This is very, VERY different from Montgomery County, where the executive is coming off a tough reelection and is now spraying money all over the place with interest groups pressuring the council to approve all of it.

All of the above comes with a caveat: D.C. raised income taxes on its wealthiest residents two years ago. It did not do that because it had financial problems – the city had tons of federal pandemic money – but because its city council wanted to spend more money on “housing vouchers, subsidies for day-care workers’ wages and monthly tax credits for low-income families.” Council Member Will Jawando would like to raise taxes on high income residents too, but state legislation allowing it did not get out of General Assembly committees this year.

With the above caveat in mind – and also remembering that Anne Arundel County has not yet proposed a FY24 budget – none of the region’s other large jurisdictions have proposed huge property tax hikes this year even though we all have similar challenges.

At this writing, Montgomery County is the only one.

Update: Anne Arundel County Executive Steuart Pittman has proposed an FY24 budget with three tax increases. First, he would add an income tax bracket of 3.2% for single filers with $400,000 or more in income and joint filers with $480,000 or more. All other taxpayers would pay rates of 2.7-2.8%. Most large counties in Maryland (including Montgomery) tax all income at a rate of 3.2%, the maximum allowed by the state. Second, he would raise the property tax rate by 4.7 cents per 100 dollars of assessed value. This is less than half the proposed property tax hike in Montgomery County. Third, he would raise the hotel tax from 7% to 8%. Pittman claims that with these rate increases, Anne Arundel would still have lower tax rates than its neighbors. His budget now goes to the county council for consideration.