By Adam Pagnucco.

Every now and then, when I program a post for publishing, I know it’s going to throw a rock into the soup. Normally, the splash hits a few local folks and maybe a handful of others around the state. But my Monday morning post Has MoCo Been Redlined by the National Real Estate Industry? has gone national. And the message is yeah MoCo, you are redlined.

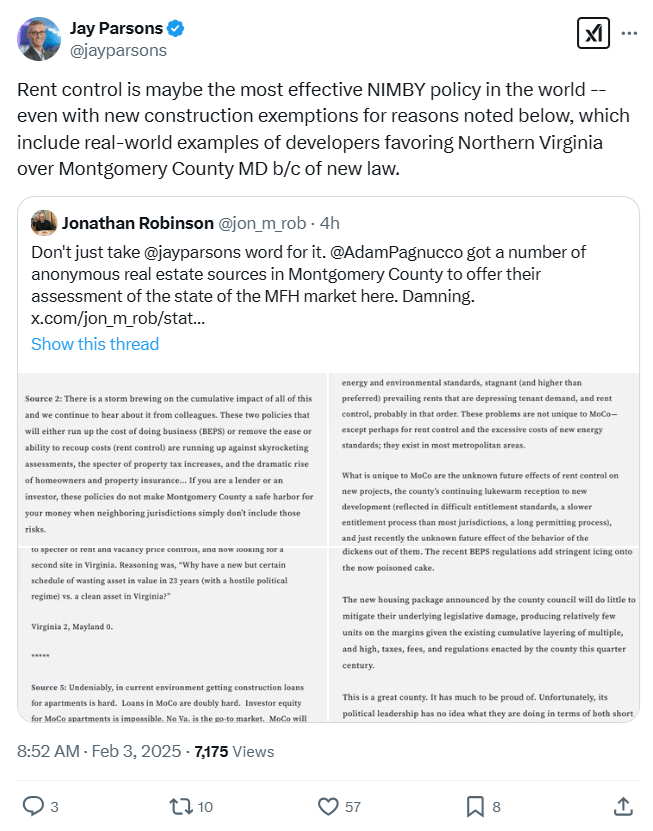

The table was set by my friend Jonathan Robinson, a national political data cruncher and a well-known MoCo housing supporter. He posted my column on X and tagged Jay Parsons, the national real estate writer whose account of the multifamily housing industry’s conference in Las Vegas formed the basis of my first post. Here is how Parsons referred to us:

Regulatory risk is MUCH bigger variable than ever. Some groups are even trying to figure out how to model future regulatory risk that could torpedo pro formas and exit strategies as occurred in places like St. Paul, MN, and Montgomery County, MD. Some coastal cities (LA, SF, OAK, NYC, DC’s Maryland suburbs) have been redlined by many institutions that previously favored gateway cities, for both development and acquisitions. “Gateway adjacent” markets (i.e. Orange County, Northern New Jersey) and politically stable suburbs remain favored.

After Robinson tagged him, Parsons chimed in, “Rent control is maybe the most effective NIMBY policy in the world — even with new construction exemptions for reasons noted below, which include real-world examples of developers favoring Northern Virginia over Montgomery County MD b/c of new law.”

Of course, Parsons is right. Look no further than Takoma Park, which has seen no new multifamily buildings constructed since it established rent control more than 40 years ago.

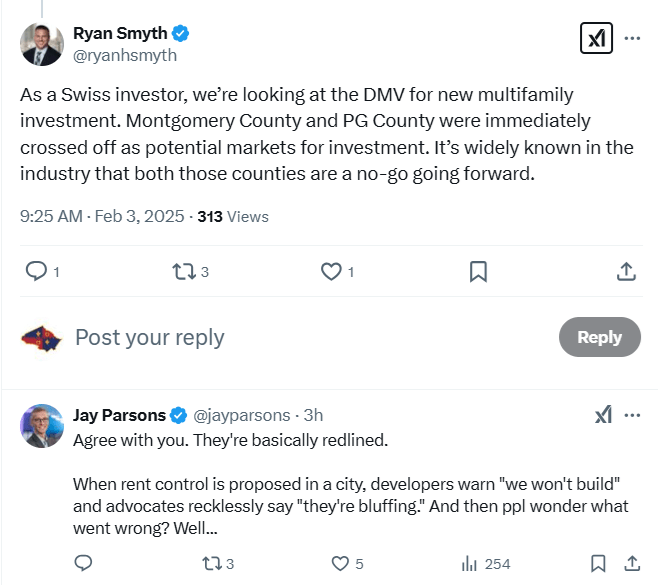

Next came Ryan Smyth, the Senior Director of Acquisitions for Stoneweg, an apartment investment firm whose U.S. office is in St. Petersburg, Florida. Smyth claims to have “personally sourced and closed” more than $770 million in assets around the country.

Smyth wrote, “As a Swiss investor, we’re looking at the DMV for new multifamily investment. Montgomery County and PG County were immediately crossed off as potential markets for investment. It’s widely known in the industry that both those counties are a no-go going forward.”

Parsons replied, “Agree with you. They’re basically redlined. When rent control is proposed in a city, developers warn ‘we won’t build’ and advocates recklessly say ‘they’re bluffing.’ And then ppl wonder what went wrong? Well…”

That’s not all. Now comes Scott Choppin, the CEO and Founder of Urban Pacific Group, an urban infill developer based in Long Beach, California. (Urban infill is what many MoCo politicians say they want.) Choppin claims to have completed 27 projects with a pipeline of $250 million more. Choppin wrote, “They’ve forgotten (or never knew) the recent examples of this effect: St. Paul (48% decline in 2022 after implementation in 2021). By 2024, worst construction numbers since the Great Depression. Los Angeles, 25% decline from 2022 numbers in the post-ULA 2022 era.”

See, here’s the thing: our politicians did know about St. Paul, where the establishment of rent control drove building activity into nearby Minneapolis, because I wrote about it months before our rent control law was passed. As a matter of fact, I wrote more than 20 posts about rent control in the months leading up to the vote and even wrote a cumulative lessons learned post in case county leaders missed a few. (It happens!) So our leaders knew all about what rent control would do and they approved it anyway. To their credit, Council Members Gabe Albornoz, Marilyn Balcombe, Andrew Friedson and Dawn Luedtke voted no. But the rest of them absolutely own the red line that now surrounds us.

Montgomery County’s leadership likes to believe that we are an example for other local jurisdictions. And on this issue, YES WE ARE – but not in a way our leaders might enjoy. The national real estate industry agrees.