By Adam Pagnucco.

The county council has released videos celebrating the legacies of departing Council Members Tom Hucker, Nancy Navarro, Craig Rice and Hans Riemer. These council members are right to point out their accomplishments, but here is one part of their legacy that will never appear in any taxpayer-funded video:

The Tax Revolt of 2016.

This unusual event began with the U.S. Supreme Court case of Comptroller v. Wynne. The case originated with Howard County residents Brian and Karen Wynne, who earned income from other states and applied for credit against their state and county income taxes on their Maryland income tax returns. The comptroller granted credit against state income taxes but not county income taxes. That started a chain of litigation eventually leading to the U.S. Supreme Court, which ruled in 2015 that Maryland’s failure to grant credits against county income taxes violated the constitution’s Commerce Clause.

This created a big problem for the counties, which could no longer tax out-of-state income in the future and now owed refunds to affected taxpayers on many returns going back to 2011. Montgomery County was the hardest hit, as it accounted for $115 million of the roughly $200 million in refunds owed. The state agreed to issue the refunds but then the counties would owe money back to the state to pay for them.

Montgomery County was still recovering from the Great Recession, so County Executive Ike Leggett included an 8.7% property tax hike in his recommended FY17 budget in part to pay for the Wynne obligations. Leggett wrote, “A substantial portion of my recommended property tax increase would not be necessary were it not for the impact on our revenues of the Comptroller of the Treasury of Maryland v. Wynne.” He estimated that Wynne alone would cost the county $76 million in both FY17 and FY18, a hole that had to be plugged.

As the county council prepared to work on Leggett’s budget in the spring of 2016, a fortuitous event occurred: the General Assembly passed Senator Rich Madaleno’s bill to extend the time that the counties had to repay Wynne obligations. That saved the county $34 million and Leggett asked the council to cut the size of his tax hike accordingly. That amount plus level-funding many agencies enabled the council to cut the size of the tax hike in half. And with an aggressive savings plan, it’s even possible that a tax hike could have been avoided.

But that’s not the path the council chose. Instead, they pocketed Madaleno’s savings and passed the entire 8.7% property tax hike. My sources inside the council building explained to me at the time that since they did not raise property taxes often (the last increase happened 8 years before) they should maximize revenue whenever one was passed. The thinking was that a small hike would arouse as much unhappiness as a big hike, so they may as well raise the most money they could get. They sold the tax hike as funding an “Education First” budget even though the money was spread across all of government and passed it unanimously. Council Member Marc Elrich declared at the vote, “There are no civilizations in history that are remembered for their tax rates, none.”

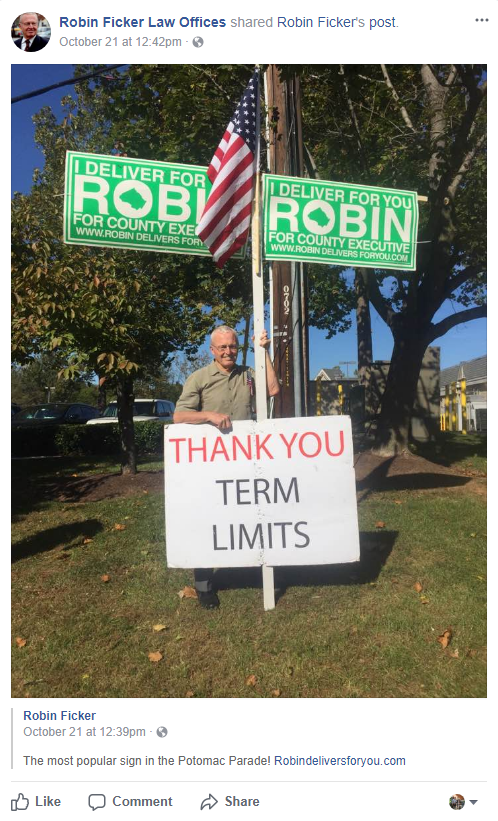

The council maximized the revenue. They also maximized voter outrage. While the tax hike passed, Robin Ficker – author of numerous charter amendments on taxes and other issues – was gathering signatures for a new charter amendment instituting term limits. A month after the tax hike passed, I predicted that it would help Ficker succeed and would lead to more charter amendments on taxes. The council scrambled to stop him and lost a ballot challenge in court, resulting in an epic revolt by the voters.

Term limits was passed by 40 points. In addition, it passed in every congressional district, every state legislative district, every county council district and every large community in the county except for Takoma Park. Precincts of all racial and partisan compositions voted for it. It failed in just four of the county’s 257 voting precincts. It was by far the biggest triumph for Ficker in his decades of promoting charter amendments.

Ficker celebrates his ultimate victory.

This is not a legacy that the departed council members sought, but it is meaningful and long-lasting.

Term limits, whether they were a good idea or not, have increased political competition. Never again will there be council members like Neal Potter, Marilyn Praisner and Mike Subin, who all won five straight elections for their seats. Instead, every seat – including the executive’s – is guaranteed to turn over at least once every twelve years. One can argue whether new occupants of those seats are all that different from prior ones, but at least the voters can make picks among them in the occasional absence of incumbency.

Then there is the matter of taxes. The Tax Revolt of 2016 led directly to the council’s unanimous rejection of County Executive Marc Elrich’s proposed property tax hike in 2020. Indeed, of the council members opposing it, five – Hucker, Navarro, Rice, Riemer and Sidney Katz – voted for the calamitous 2016 tax hike. Little talk of tax increases was heard from county government thereafter and Elrich preposterously claimed credit for not raising taxes in his second inauguration speech. We shall see how long this attitude lasts.

I don’t mean to say that this is the only legacy of the departed council members. Nancy Navarro was a champion of equity and possibly THE most effective council member I have ever seen in delivering resources to her district. The new Park and Planning headquarters in Wheaton should be named after her because she was the primary mover in getting it built. Tom Hucker was a dedicated and reliable progressive who was particularly aggressive on tenants’ rights. Craig Rice was a voice of reason who ably represented his Upcounty district. And Hans Riemer, my former employer, turned into one of the foremost smart growth champions in the county and was especially active on housing. They have every right to discuss the high points of their tenures.

But the Tax Revolt of 2016 was a watershed event demonstrating that voters would defend themselves from politicians who failed to respect them. This legacy must be remembered by every member of the new county council.