By Adam Pagnucco.

The county council’s Office of Legislative Oversight (OLO) has struck again, telling the council that another one of their bills will hurt the economy. (They did this last week on rent control legislation.) This is one of the top reasons why every legislature needs a professional merit staff – sometimes they must tell the elected officials what they need to hear even if they are not going to like it.

The economic impact statement on Bill 17-23, the recordation tax hike introduced by Council Member Kristin Mink and co-sponsored by Council Member Will Jawando, begins with this summary.

*****

The Office of Legislative Oversight (OLO) anticipates that enacting Bill 17-23 would have a small to moderate negative impact on economic conditions in the County in terms of the Council’s priority indicators. By increasing the recordation tax, the Bill would increase the total cost of transactions for property transfers. In the residential sector (the focus of this analysis), certain buyers and sellers would pay higher closing costs than they otherwise would in the absence of the policy change, resulting in a one-time net increase in nondiscretionary expenses. Moreover, based on a review of the economic literature on the impacts of transfer taxes for residential properties and data on residential home sales in the County around the time the Council increased the recordation tax rate in September 2016, OLO believes there is a moderate likelihood the Bill would result in a short-term reduction in the volume of home sales in the County.

*****

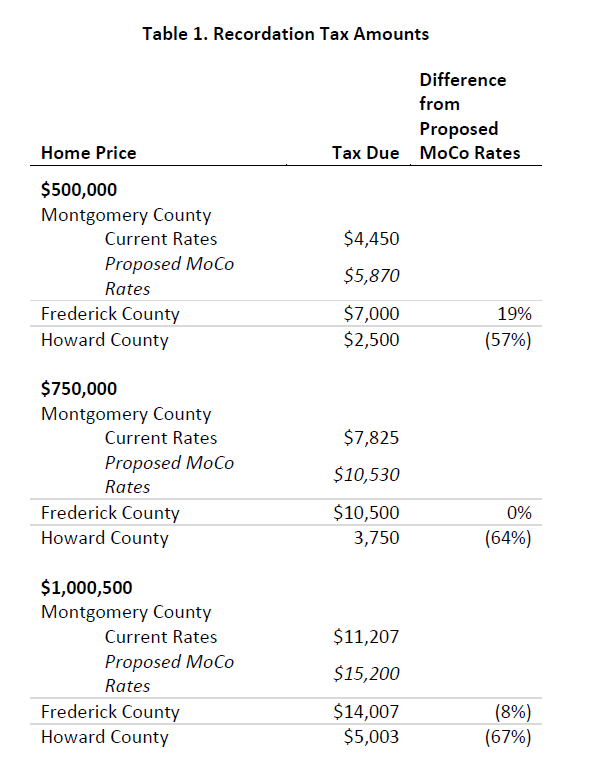

This is obviously bad news for realtors, who earn commissions on home sales. But it’s also bad news for anyone trying to buy a home here and the market is already very tight. The recordation tax has several components and the bill increases it in a progressive way. That means it has different impacts at different levels of home prices. The economic impact statement uses a variety of scenarios to illustrate how the bill would raise taxes. It also compares our recordation taxes to Frederick and Howard counties as seen in the graphic below.

For a $500,000 home, the bill would raise taxes by $1,420, or 32%. For a $750,000 home, the bill would raise taxes by $2,705, or 35%. For a $1,000,500 home, the bill would raise taxes by $3,993, or 36%.

These are big tax hikes folks! The taxes would be far higher than in Howard County but in the first scenario would be lower than in Frederick County. Let’s point out that while Frederick has the highest recordation tax rate in the state, it has a lower income tax than Montgomery.

OLO finds mixed evidence on how increases in recordation taxes impact sales volumes but the impact on buyers and sellers of homes is hard to dispute. OLO had the following comments about resident impacts.

*****

OLO anticipates that enacting Bill 17-23 would have a negative impact on certain residents in the County in terms of the economic indicators prioritized by the Council.

The Bill would primarily impact residential home buyers and sellers. By increasing the total cost of residential home transactions, certain buyers and sellers would pay higher closing costs than they otherwise would in the absence of the change in the recordation tax. Holding all else equal, they would experience a one-time net increase in nondiscretionary expenses.

Certain homebuyers may compensate for the increase in the total transaction cost by lowering their price range, thereby purchasing an asset less valuable than they otherwise would absent the policy change. It is worth noting certain residents could incur indirect costs from lowering their price range given the competitiveness of the County’s residential housing market (e.g., paying additional months of rent or mortgage due to timing constraints).

Moreover, as suggested by studies that have found higher transfer taxes reduce home sales, certain residents may respond to higher recordation taxes by remaining in their current residence and/or expanding their search to more affordable housing markets. If sufficient in magnitude, a net decrease in demand in the local housing market (even if temporary) could have mixed impacts on other buyers and sellers. For instance, certain sellers may accept lower offers than they otherwise would in the absence of the recordation tax increases, which would benefit certain buyers.

****

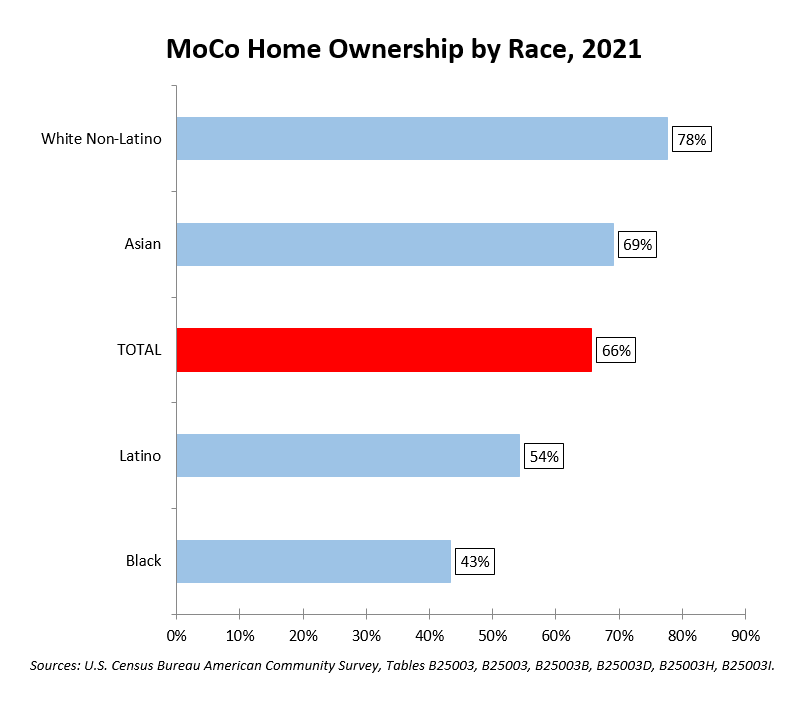

Finally, it’s worth mentioning a fact that does not appear in the economic impact statement: Black and Latino residents have lower home ownership rates than White and Asian residents. To the extent that homebuying becomes more difficult, those disparate rates will become more locked in. Mink and Jawando frequently discuss equity so they should pay heed. Below is the chart on home ownership that I developed from Census data and originally printed back in January.

The bill is intended to fund capital projects and rental assistance. No one can dispute that the county could totally use more money for both of those needs. But it’s darkly ironic that this bill attempts to increase rental assistance funding at the cost of making it harder to buy homes, even modest homes selling for a half million dollars. The council will have to decide whether this tradeoff is worth it as the bill moves forward.

The full economic impact statement can be downloaded from the link below.