By Adam Pagnucco.

Minutes ago, the Montgomery County Council voted 7-4 to increase property taxes by 4.7 percent. The increase is much less than the 10 percent proposed by County Executive Marc Elrich but is necessary to fund increased spending in the FY24 budget, particularly for MCPS.

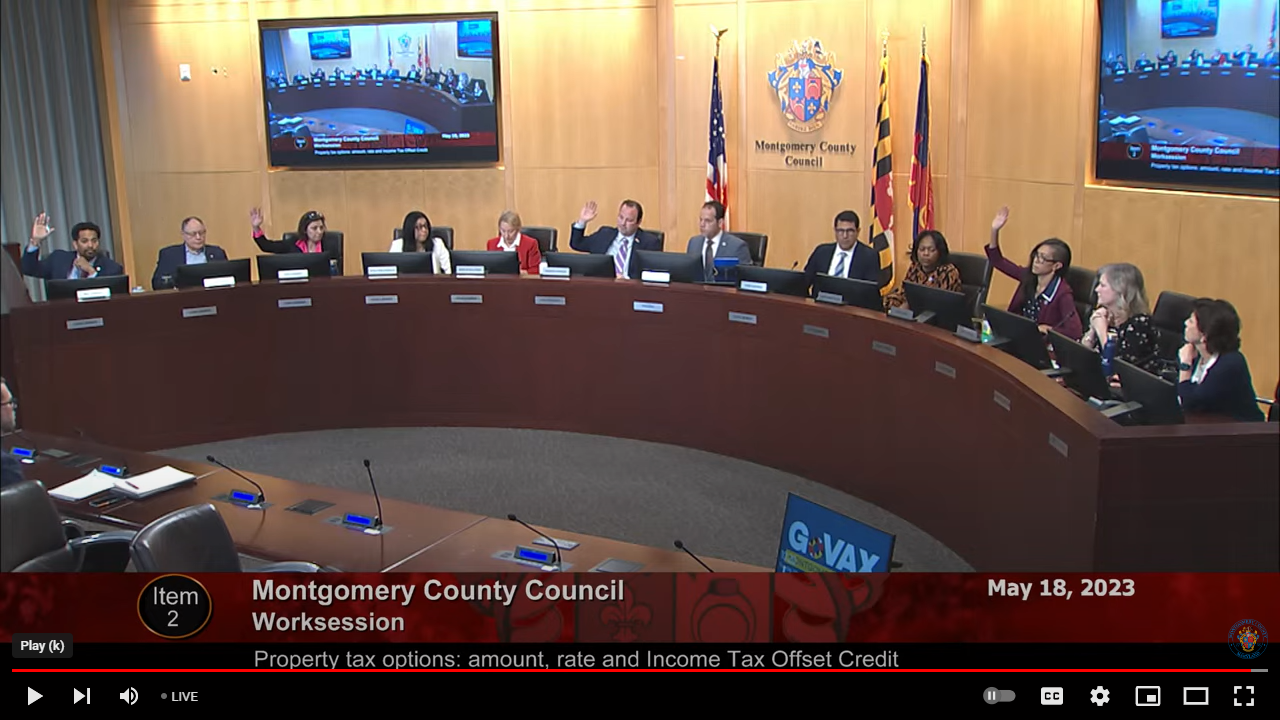

It was apparent that there was no love in the room for the tax increase. Even its defenders seemed to hold their noses as they voted for it. But it’s the no voters – Council Members Kate Stewart, Will Jawando, Andrew Friedson and Kristin Mink – who were more interesting because they had different reasons for opposing it. Let’s hear from them.

The no voters – Stewart, Jawando, Friedson and Mink.

Kate Stewart

Stewart wanted a higher tax hike because she is concerned about the use of reserves for ongoing spending in the budget. Here is what she said.

*****

I feel to achieve the proposed tax rate that we have before us right now, we are using one-time resources to reduce the tax rate and creating fiscal challenges for our future. Decisions were made through our process that some items that we are going to have to pay for in the future will need to come out of our reserves. As the chair of Government Operations Committee, I have spoken publicly and repeatedly about my concerns about this budget and about the use of one-time funds and reserves for continuing programs and operations that I believe should either be tax supported or funded through reliable funding streams. While we did make some adjustments and I will speak to that later when we speak to the whole budget, the decisions that we have made related to the tax rate leave me very concerned. Particularly as many of us have talked about, we may be headed into a recession in our country.

So I think we are in a tough position, and again, I very much respect my colleagues and thank you for the work that you all have done and your interest in lowering the tax rate. I have agreed and stated that when we got this budget from the county executive that what was proposed at that time from him was too much and I’m probably not too far away from where my colleagues are now. But I believe that pushing to the lower tax rate by dipping into our reserves that otherwise I feel really should just be used for emergency spending is creating fiscal challenges for us in the future. And the bottom line for me is I don’t see it as sustainable.

*****

Will Jawando

Jawando wanted a higher tax hike. He echoed Stewart’s concerns about “artificially” lowering the tax rate by tapping reserves but most of his remarks focused on MCPS. Here is an excerpt from his statement.

*****

We got a letter yesterday from the superintendent and the board that said a couple of really important things. That if we are funding them at 7 increments, which this increase proposes to do, they would still have a gap of nearly $90 million, $89 million, to cover the $8 million that was cut out of their request from the executive, the $22.3 million that we took out in the education and culture committee, and the Blueprint costs and inflationary costs that they have. And they say that in order to do this, they are going to have to shift – move $15 million from the operating budget to the ESSER grant, which as the conversation we just mentioned is a one time – it’s going to run out, that money runs out and is already allocated, that they will have to reduce between $6 and $8 million in the base budget. They would also have to do additional lapse in turnover and that to require, to achieve the rest of the savings, they’re going to either need to increase class sizes between 0.5 and 2 students across grade level or renegotiate agreed upon compensation packages which include not just the salaries but things that teachers need like when they do tutoring or what the rates are they’re paid to help our students after school and the like.

They say we could avoid most of this, but still have to do a lot of it, if we added a half tranche, which would be basically $11 million, to what is currently designated by priority. And in this case would yield, would be a 5.2 percent tax increase. Now it took us awhile to get here. We all wanted to cut the fat and say what’s the lowest you could go. We’re here. And I don’t think as a parent of MCPS kids, I don’t want class size going up. 0.5 to 2 students per classroom into classes that are already stressed, for teachers who are already stressed. I don’t want them not getting an increase for tutoring after school. I think it would be well worth the additional 0.5 on the tax rate. I won’t make a motion because I don’t think there’s a second. But I will say it’s regrettable that we are not only doing in our budget what the GO chair said, moving things to the reserves and kicking the can down the road, it’s also going to be a problem next year because the ESSER funds will run out. And whatever emergency measures the school system takes to use that fund to backfill some of this, which will still result in deep cuts, are going to be back before us next year. And that’s not where we should be. It’s not good for our students, it’s not good for our budget, and for those reasons I will be voting against the tax rate as well.

*****

Andrew Friedson

Friedson thought the tax hike was too much. Here is what he said.

*****

I want to acknowledge the challenges that the county executive’s recommended ten percent property tax increase created for this council and the false premise that was established by invoking a never before used provision of state law which bypasses the unanimous vote requirement in the county charter. This property tax increase is not required to fund schools at the historic level we’re prepared to approve today or to fund teacher pay raises, both of which I support. I truly appreciate colleagues for the diligent work over the past two months combing through this budget and bringing up and raising and addressing very important issues. The nearly 5 percent rate under consideration today is far better than what the county executive proposed. However, with rising assessments, cost pressures on residents and families and looming economic uncertainties, I have deep concerns with a property tax increase, especially of this size at this time.

We did have choices. We could live within our means of a more than six and a half billion dollar budget. We could have prioritized the people providing public services and educating our kids without adding new positions or new programs. We simply can’t do everything all at once. Other jurisdictions around us have found ways to fund public education and support public employees without raising taxes. I know that we could have to. I recognize the challenging decision that colleagues are faced with today and have been faced with over the last two months but I do believe we had other options, admittedly difficult ones, that could have avoided this property tax increase. For that reason, respectfully, I won’t be supporting the motion.

*****

Kristin Mink

Mink wanted a higher tax increase to give more money to MCPS. She echoed many of Jawando’s points about its budget. Here is an excerpt from what she said.

*****

I believe that residents understand that taxes are necessary to sustain high quality public services. Taxes are also necessary to balance revenue and expenditures. And by asking MCPS to spend one-time funds on ongoing expenses, by being unwilling to tax commensurate with our spending, we are helping create and worsen the conditions for a very bad budget situation next year.

There has been a lot of conversation about the MCPS budget as there should be. It’s a big number because it’s a big system. And it’s more heavily impacted now than ever. And I say that as a former MCPS teacher myself. For perspective in this budget, the county contribution to MCPS is growing by roughly 8.5 percent over last year, which is substantial. But manty county department budgets are growing by more than 10 percent. As of nearly everyone who came before us, MCPS came in with an aspirational request and eventually let us know what is truly the minimum needed. And in their case, that means the minimum to fund employee contracts, prevent class sizes from increasing as enrollment grows and provide adequate service to our students in a time of deep need. And this body has decided not to meet that minimum.

And it’s a gamble. It’s a gamble. And I don’t think it’s the right gamble.

We have all noted that with this funding level MCPS will technically have the funds in the bank to pay for the employee contracts. And they must do that. That must be priority number one. The problem is MCPS has never said we will not have the money in the bank to cover contracts. What they’re saying is they can’t fund the contracts without sacrificing class sizes or making other cuts that will significantly impact the classroom. That’s what they’re saying. We have record numbers of students living in poverty, receiving special education services, learning English as an additional language, enrollment is now growing at 2,000 students per year. We are bleeding staff. And we’re relying on MCPS not only to educate our children but as a critical part of our healthcare delivery system, of our workforce development plans, as a touchpoint for families struggling with food insecurity and other critical issues. What we do not want is students next year having it worse than students this year. And I think that is a very real potential outcome here.

I think it would be reasonable and right to ask residents to pay a little more than the proposed property tax rate on the table right now in order to fund more of the MCPS request and other obligations that we have agreed to in public. And I think most residents would have supported that. For that reason, I cannot vote for this tax rate.

*****

We shall see if MCPS’s dire predictions come true. Let’s remember that they reported an $87.5 million fund balance at the end of FY22 with tens of millions in liquid assets. I will be very interested to examine their next transfer request this fall, which usually siphons instructional salary money to other purposes, and the FY23 fund balance they report this winter.

Council President Evan Glass had a discussion with staff relating the tax hike to the full budget. He pointed out that the council unanimously voted for all of the agency and department budgets now on the reconciliation list. He also obtained confirmation from staff that a 4.7 cent property tax hike was required to fund all of those budgets. Glass didn’t come out and say it, but his implication is that it would be hypocritical to vote against the tax hike but then vote for the budget it supports. We shall see if anyone does so.

There will be a lot more to come about this, including the council’s statement on the budget that will be passed later today. For now, this is the third tax increase announced in the last ten days following the impact tax and the recordation tax. As few local jurisdictions in the region are raising taxes and Fairfax, Loudoun and Prince William counties are cutting property tax rates while increasing school funding, we shall see how this plays out in the future.