By Adam Pagnucco.

In the wake of last spring’s 4.7% property tax hike, which was levied in part to fund a big budget increase for MCPS, the school system is projecting $160 million in new spending next year. If that happens, another tax hike will surely be on the table.

First, some background. In March, County Executive Marc Elrich proposed a 10% property tax increase. While the tax hike was structured under state law to go to MCPS as a way to avoid the county’s charter limit on property taxes, it was actually spread across the county budget because money is fungible. The county council adopted a 4.7% tax hike instead which was used in part to give MCPS its biggest budget increase in at least 20 years. All of this occurs in the context of warnings by council staff of unsustainable spending both this year and last year as well as the presence of a long-term structural deficit in the county’s budget.

It turns out that last year’s huge budget increase may not be enough for MCPS.

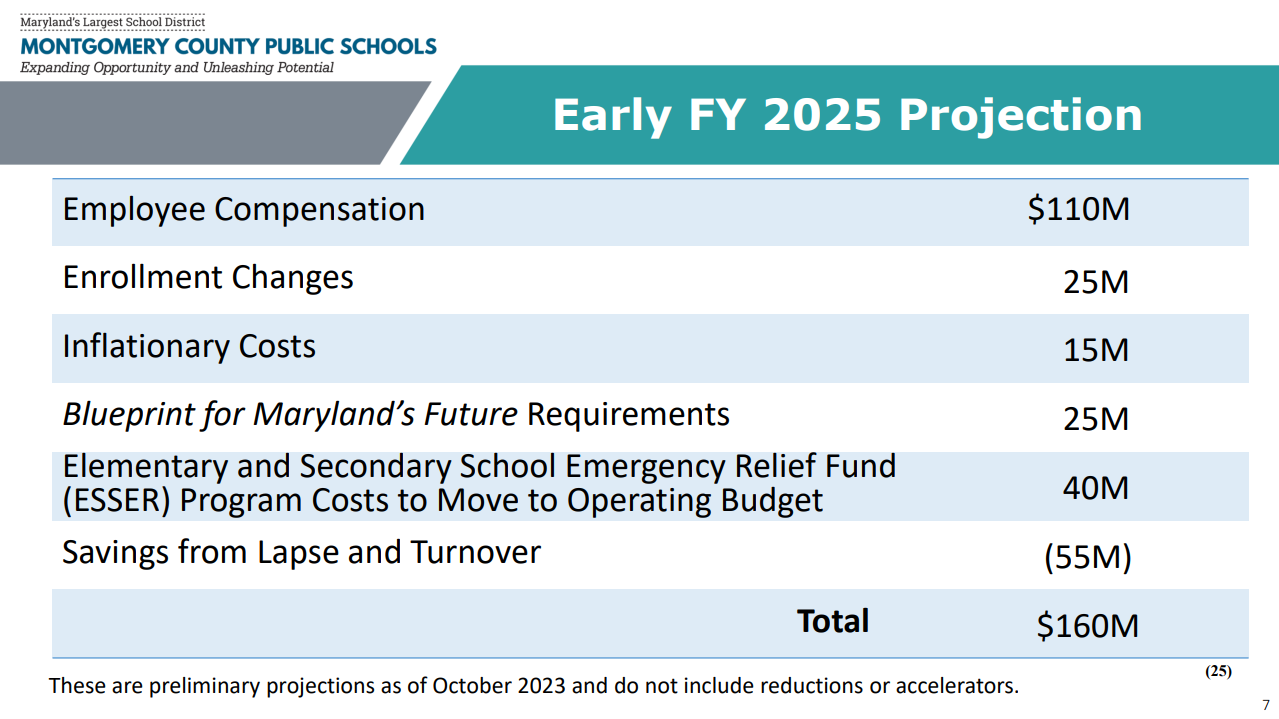

Buried in the packet for a Thursday meeting by the county council’s Education and Culture Committee is a projection by MCPS for additional spending in FY25. At the moment, MCPS is projecting another $160 million in spending for next year, anchored by $110 million in extra compensation.

This slide from circle 25 of the council’s packet says it all.

Let’s put this in context: one penny of the county’s property tax raises $22.3 million. So if this entire increase is funded by property taxes, that would currently be equivalent to a 7.2 cent hike.

That said, there are many things in play.

First, MCPS routinely asks for budget increases by justifying them through instructional salaries. However, after they are funded, they regularly transfer instructional salary money towards other purposes. They just transferred another $11.4 million out of salaries again and the council allowed it without so much as a whimper.

Second, the county’s property and income tax revenues grow naturally in most non-recession years even without rate increases. Any natural growth in revenues will be available to fund the entire government. Whatever that growth may be won’t be fully estimated until next March, though we may have a better idea in a couple months. Also available will be any increases in state aid, which goes mostly to MCPS.

Third, there is little discussion of MCPS’s large fund balance. Its new annual comprehensive financial report shows that MCPS rang up a $77 million general fund balance in the fiscal year ending on 6/30/23. That’s down from FY21 ($94 million) and FY22 ($87 million) but above any pre-pandemic year. MCPS’s fund balance has been soaring for years and the council has demonstrated little curiosity about that even as it approves annual budget increases.

Finally, the structural deficit looms. Last spring, council staff estimated it to be $145 million. Its causes are not confined to MCPS but are due to huge increases in staff and compensation all over the government, the use of one-time revenues for ongoing spending and the drying up of federal COVID aid. While I have not seen an updated number, two council members admitted to the deficit’s existence in a public event with me in June.

MCPS has legitimate funding needs. However, the council has not sufficiently scrutinized its spending, allowing regular instructional salary transfers and the accumulation of large fund balances. It has also not practiced any spending restraint in the rest of county government. While MCPS’s projected budget does not necessarily translate into a tax hike by itself, the combination of all of these factors – MCPS, countywide compensation increases, continual staffing increases, a structural deficit and economic stagnation exacerbated by county policies – may well put tax hikes on the table again next spring.