By Adam Pagnucco.

Montgomery County’s latest six-year fiscal plan contains a surprising number: the county’s tax revenues have come in $455 million above estimates over the last two fiscal years. As of June 30, the county was sending one of every six dollars it was taking in to reserves.

So why on Earth did we pay a property tax increase?

Let’s recall the events of last spring. In his recommended budget last March, County Executive Marc Elrich proposed a ten percent property tax hike (ten cents per $100 of assessed value) which would have raised $223 million. Its ostensible purpose was to fund MCPS but in reality its proceeds were spread across the entire county budget. Under pressure from MCPS, which told the county council that it needed at least eight cents of the property tax to fund its labor agreements, the council approved a 4.7 cent hike. Council Member Andrew Friedson opposed the increase and voted no. Council Members Kate Stewart, Will Jawando and Kristin Mink also voted no because they thought the tax hike was too small. That increase came on top of increases to impact taxes and recordation taxes, a tax trifecta.

The newest six-year fiscal plan shows that the revenue estimates from June were way too conservative.

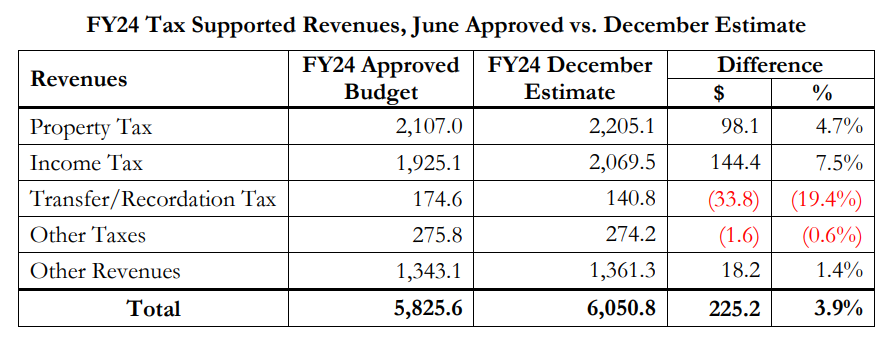

According to the table below, tax revenues are now projected to come in $225 million higher than estimated in June. The reasons included unanticipated increases to the assessable property base, some residents losing their income tax offset credits and higher income tax receipts.

Let’s do a bit of math here. Last spring, the county estimated that each penny of the property tax raises $22.3 million. That means the 4.7 cent property tax hike would have raised $105 million. The newest revenue estimates show that the county could have levied zero property tax hike and still had surplus revenues of $120 million.

There is more. In the prior fiscal year (FY23), tax revenues came in at $230 million above budget. That caused general fund reserves to soar to 16.8% of revenues, waaaaaaay above the county’s 10% goal.

Again, why did we need a tax hike?

In considering taxes, let’s look at a few items of context.

First, it’s doubtful that MCPS ever needed a tax increase for teacher salaries. Last March, months before the council levied its property tax hike, I wrote a five-part series about how MCPS regularly transfers teacher salary money to other purposes and has been running up big fund balances. MCPS proposed transferring another $11.4 million out of teacher salaries in September. The council approved it without objection or even discussion on October 3.

Second, temporary revenue bump or no, the county is definitely putting long-term pressure on its budget by expanding its workforce and pushing through big compensation increases. Since FY19 (Elrich’s first year as executive), the county’s agencies have added 2,856 full-time equivalent positions, an expansion of 8%. Let’s remember that Elrich once promised to restructure government to save money, a promise so far unfulfilled. In FY23, Elrich’s labor contracts provided raises of 7.3% to 13.5%. In FY24, his contracts provided raises of 6.0% to 13.4%. Add to that four benefits bills introduced this year alone (19-23E, 20-23E, 21-23E and 41-23E) that will have a cumulative cost of $64 million over the next six years.

Third, the county continues to add spending outside of its regular budget process. According to the fiscal plan, the county’s Office of Management and Budget “estimates that the County Government could add approximately $33.5 million in new expenditures in FY24. This estimate is based on General Fund supplemental and special appropriations that have been introduced or acted on since budget approval and potential snow removal costs.” One of these new spending items was Elrich’s $1.3 million request to implement rent control, which was due to come out of reserves. The council voted 10-1 to fund it with only Friedson voting no.

Friedson casts the sole vote against funding rent control out of reserves.

So what now? The county has a policy of using one-time revenues for one-time purposes, such as adding to reserves; prefunding pensions and retiree health care; and funding one-shot capital expenses. Last spring, Elrich ignored that policy to use one-time revenues for ongoing spending, creating an estimated structural deficit of $145 million for next year. Given the county’s unexpected revenue increase, it’s not clear whether that deficit still exists. In any case, the county’s stated policy of using one-time revenues for one-time spending is a good one and the council should stick to it. We shall see if the executive agrees.

In the meantime, let’s return to our central question: was last spring’s property tax hike necessary? If you consider the fact that the county government now banks one of every six dollars it takes in, it’s hard to argue that it’s underfunded and needs more revenues. But if the goal of county leaders is to cast aside all oversight and spending restraint, then no tax hike will ever be enough.