By Adam Pagnucco.

When Council Member Will Jawando withdrew his bill to repeal the tipped minimum wage in January, he threw his support behind efforts to pass it at the state level. However, the lead sponsor of the state bill also withdrew it, leaving advocates to press for a voter-approved constitutional amendment, the same approach they used to pass it in the District of Columbia. That’s far harder than passing a bill since a constitutional amendment requires three-fifths of all state senators and delegates to make it to the ballot. If a simple majority can’t be mustered for a bill, then a super-majority seems out of the question.

What is holding up the repeal of tipped minimum wage? The fact is that the repeal currently occurring in D.C. is shaping up to be a disaster for its restaurant industry. That was revealed by a study conducted by the county council’s Office of Legislative Oversight (OLO) and released on the same day Jawando withdrew his bill. The study could not evaluate the full economic impact of repeal because it is still being phased in and local economic data has substantial lag time in publication. However, the study did include a survey of D.C. restaurants to which 60 responded. That’s not a great response rate since 592 were contacted, but it’s not terrible considering that it was another jurisdiction’s local government that was requesting response. Another hindrance is that the survey asked about their number of employees, wage rates and monthly sales, issues which many private establishments are reluctant to put in writing.

Here are the actions the survey respondents have already taken in response to the law repealing tipped minimum wage.

82% increased prices of items on the menu

67% reduced the number of hours offered to tipped employees

53% reduced the number of part-time employees

51% reduced the number of full-time employees

33% instituted a service charge

6% increased an existing service charge 6%

17% took other actions

These are the open-ended responses received by OLO.

*****

- Increased the portion of the service charge that we keep

- Took food off menu

- None

- We will institute a service charge as wages go up

- Introduced more tech to offset labor

- Rent and insurance is tied to sales, so we had to renegotiate lease terms and shop for different insurance

- We are so small we aren’t required to offer health insurance, we stopped. The money has to come from somewhere. We have not started a service charge because a service charge is considered revenue and would drastically increase total revenue thus increase our liquor liability insurance cost. A tip is not revenue and doesn’t increase our insurance costs.

- Had no impact on us as we paid above minimum wage.

- Changed the whole concept and business model of our restaurant as our original model was wildly unprofitable under the new laws.

*****

Here are the actions the survey respondents plan to take in the next 12 months in response to the law.

82% will increase prices of items on the menu

69% will reduce the number of hours offered to tipped employees

53% will reduce the number of full-time employees

47% will reduce the number of part-time employees

29% will institute a service charge

22% will increase an existing service charge

10% will plan other actions

These are the open-ended responses received by OLO.

*****

- Reduce service hours, reduce menu items

- We aren’t sure, there’s a lot of confusion in the public

- Increase an existing service charge

- Probably close

*****

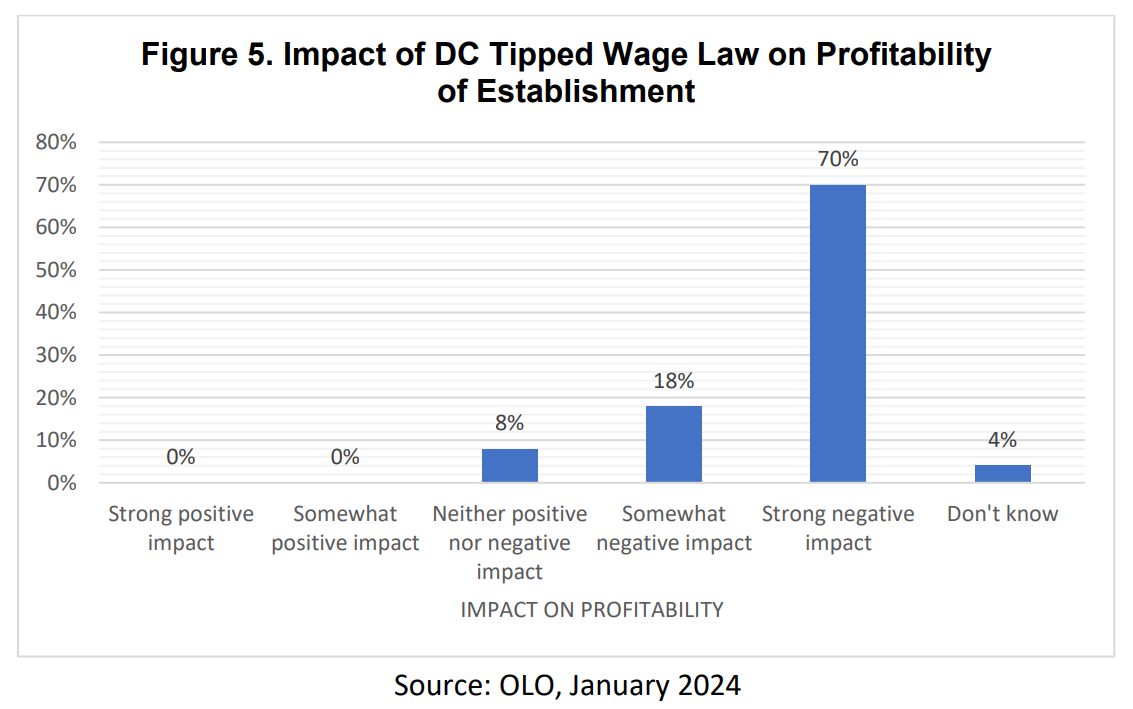

70% of respondents said that the law had a strong negative impact on profitability. Another 18% said that it had a somewhat negative impact on profitability. See the chart below.

Accordingly, 78% strongly opposed the law and another 8% somewhat opposed it. Just 8% supported it.

Let’s stress that this survey was not conducted by the restaurant association. It was conducted by a legislative branch office.

I can’t blame Jawando for withdrawing his bill in the face of these survey results. If he did not have the votes to pass it before the survey was released, he was definitely not going to get them after it came out. I am sure that many state legislators will have a similar reaction when they see the OLO’s findings.

There are a few states that don’t have tipped minimum wages, including California. Those states do have restaurant industries, proving that restaurants can and do operate without tipped minimums. But the D.C. experience shows that the transition from one system to another can be painful and it’s an open question whether its law will someday be reversed. Given the reluctance the General Assembly has expressed about going down that road, and the data that is now starting to show up, it seems that Maryland is unlikely to follow D.C.’s example anytime soon. That may be just as good for restaurant employees as it is for their employers.