By Adam Pagnucco.

Montgomery County’s charter prohibits long-term debt from being used to finance current operating expenses, meaning that current annual operating budgets must be balanced. However, the charter says nothing about whether future operating budgets must be balanced. That opens the door to structural deficits in out years, and according to county council staff, that is exactly what County Executive Marc Elrich’s recommended FY25 operating budget does. The size of the structural deficit?

$115 million in FY26.

A council staff memo breaks down the hidden consequences of Elrich’s budget. The staff begins with this:

*****

Council staff has concerns about the Executive’s proposed use of one-time resources for ongoing expenditures, sustainability of spending growth given projected resources, and a potential structural deficit as early as FY26:

The Executive’s proposed budget is not consistent with the Council’s adopted fiscal policies on use of one-time reserves.

The Executive’s budget would result in a 13.2% increase in tax supported expenditures from FY23-FY25.

The Executive’s budget commits the County to future funding increases for MCPS under the Maintenance of Effort law.

The Executive’s recommended budget creates an estimated structural deficit of approximately $115 million in FY26.

*****

A few elaborations on the above points.

First, council policy requires that one-time revenues be used for one-time purposes, not ongoing spending. Elrich’s budget violates that policy. Council staff writes, “The Executive’s proposed budget is not consistent with the Council’s adopted fiscal policies on use of one-time reserves. The Executive uses $237.9 million in reserves in FY25, with approximately $101.8 million funding ongoing expenditures. This action is not consistent with the Council’s fiscal policies which requires that one-time revenues, such as excess reserves, only be used for one-time expenditures.”

Second, the executive’s funding for MCPS creates long-term liabilities under state law. This has been a concern for county budget writers since the Great Recession. Council staff writes, “The Executive’s proposal funds MCPS at $132.8 above the local funding minimum, which will commit the County to future MCPS funding increases under the Maintenance of Effort (MOE) and Blueprint laws. The Executive’s recommended funding for MCPS would raise the per pupil local contribution to $13,611. The MOE law requires the County to provide the same, or higher, local per pupil contribution in future years. Based on current enrollment projections, the new per pupil contribution level would require $30.7 million in additional funding for MCPS in FY26. At the same time, the Council continues to raise questions around how it can ensure that increased funding for MCPS achieves intended outcomes.”

I have questions of my own about how MCPS spends its money.

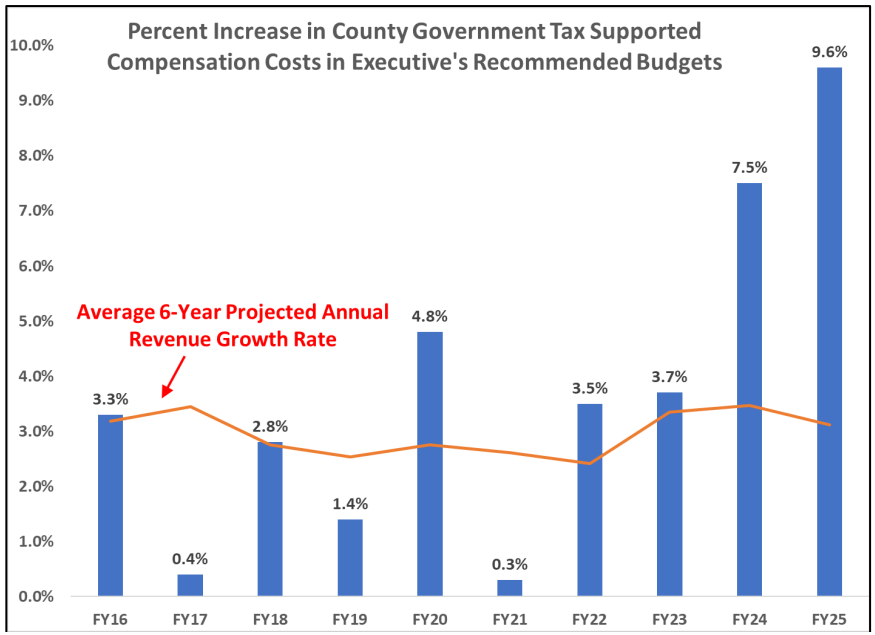

Finally, there is the executive’s compensation increases. This is a factor in Montgomery County Government but not in MCPS, Park and Planning and the college, which negotiate their compensation separately. Council staff writes, “The Executive’s recommended budget includes $116 million in tax supported compensation costs above the FY24 level, a 9.6% increase.” The chart below compares annual compensation growth (in blue bars) to average six-year projected annual revenue growth (in the orange line).

See the huge difference between the blue bar at right (in FY25) and the much lower orange line? That’s the difference between compensation growth and revenue growth. Council staff writes this about compensation: “…This recommended increase is more than three times the projected annual six-year revenue growth rate of 3.1%, and the largest percent increase in almost two decades.”

Translation: Elrich is growing compensation at three times the rate of the county’s ability to afford it.

Given that annual operating budgets must be balanced, how can this happen? The trick is that Elrich often negotiates compensation increases that take effect in the middle of the fiscal year. So the cost in this fiscal year is less than the fully annualized cost, which takes effect in the following fiscal year. That makes the compensation increase look more affordable than it really is because in the current fiscal year, when the operating budget must be balanced, we are only paying for part of it. It’s only in the next fiscal year that we have to pay the entire cost. And then there is going to be another increase on top of that.

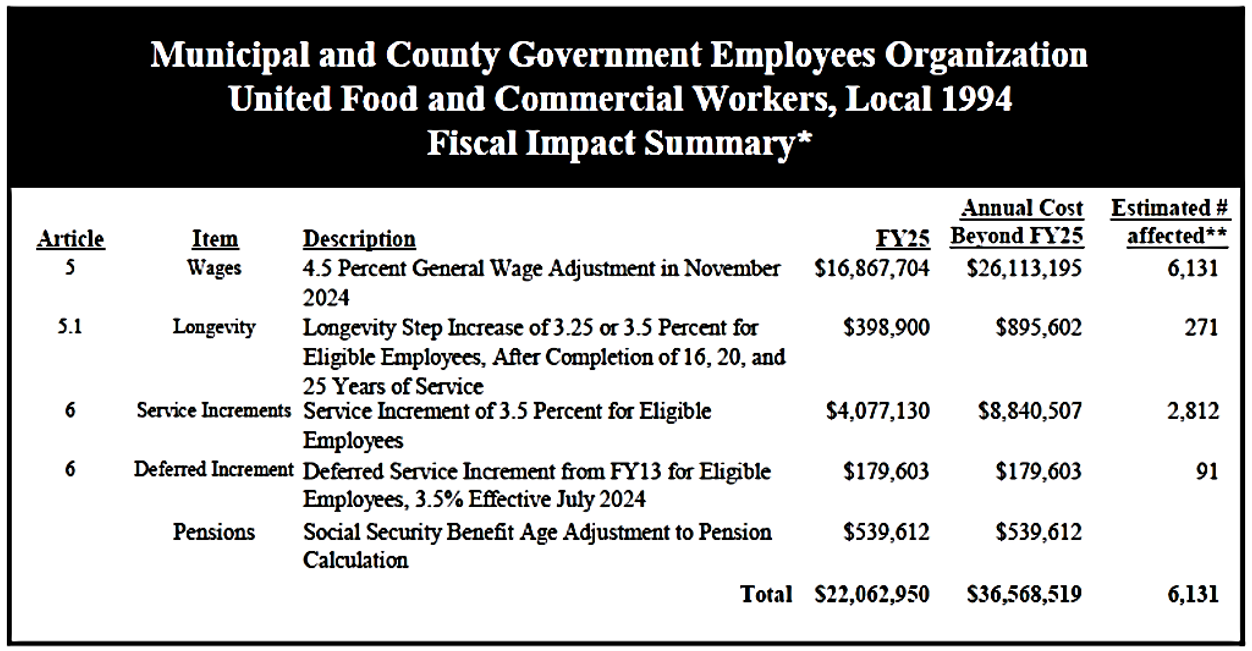

For example, take Elrich’s agreement with MCGEO, the county government’s largest union, in FY25. The fiscal year begins on 7/1/24. Some compensation increases take effect at the beginning of the fiscal year, so their cost this year equals the annualized cost. But the largest compensation increase, the 4.5% general wage adjustment, takes effect in November. The 3.5% service increment also appears to be phased in. The result is that this agreement costs $22.1 million in FY25 and then $36.6 million in each fiscal year thereafter. This is an important source of structural deficits. Check out the graphic below to see how this math works.

In the end, here is the council staff’s calculation of the structural deficit that Elrich’s budget is expected to produce in FY26.

A year ago, I published They Were Warned, which remains one of the most-read posts ever on Montgomery Perspective. That post tells the story of how council staff warned the council in 2022 that mounting unsustainable spending was leading to a structural deficit in FY24. As it turned out, FY24 was the year that Elrich proposed a 10% property tax increase, which the council later trimmed to 4.7%. (The council also raised impact taxes and recordation taxes.) Shortly thereafter, council staff warned of another structural deficit in FY25. And now they are warning of yet another structural deficit in FY26.

How many warnings do county leaders need?

This is why we get tax hikes.