By Adam Pagnucco.

It’s finally happening. In an event presaged by early signs of deterioration in the county’s (and the region’s) economy, Montgomery County’s revenues are now projected to collapse. And the costs will no doubt prove expensive for taxpayers.

No one should be surprised about this. Trump administration actions have resulted in layoffs of federal employees and contractors for months. The Brookings Institution found economic problems throughout the region (and especially MoCo) in September. The state has been struggling with economic and budget problems all year, and since MoCo accounts for more than a fifth of the state’s gross domestic product, that was bound to mean trouble for us.

Now the county estimates the size of that trouble at $854 million over the next six years. That’s the amount of the county’s revenue writedown, one that brings back terrible memories of the Great Recession.

On Friday, the county’s newest six-year fiscal plan appeared on the county council’s agenda. Consider the following estimates that it contains.

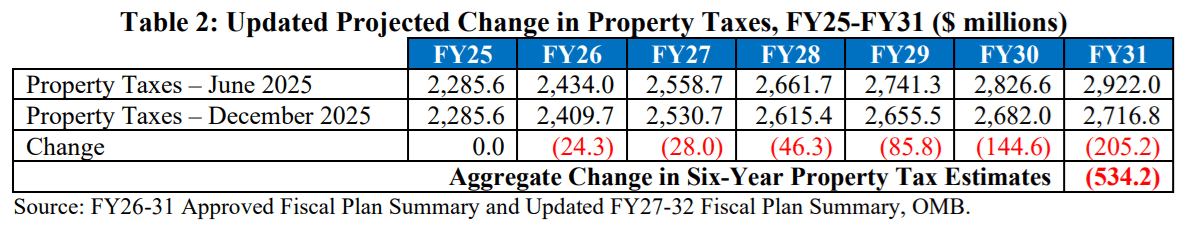

Property tax receipts are written down by $534 million over six years.

In most years, property taxes are the largest source of revenue for the county. The table below shows how estimates of property tax receipts from the June version of the fiscal plan (top row) compare to the newest version of the plan (beneath it).

For the relatively small reduction of $24 million in the current fiscal year (FY26), council staff wrote, “This reduction is mostly due to reductions in the assessable tax base from appeals and greater payments for the Income Tax Offset Credit than budgeted.”

The reference to property assessment appeals is interesting. Who is appealing? Is it office building owners? Office building vacancy rates have remained stubbornly high since the pandemic. Is it multifamily building owners who have lost value because of rent control? One of the earliest signs of the county’s rent control disaster was when apartment building transactions collapsed last year. In any event, the virtual disappearance of multifamily building construction will inevitably clobber growth in the county’s assessable base. My sources and I predicted that rent control would damage the county’s tax base two years ago and county leaders passed it anyway.

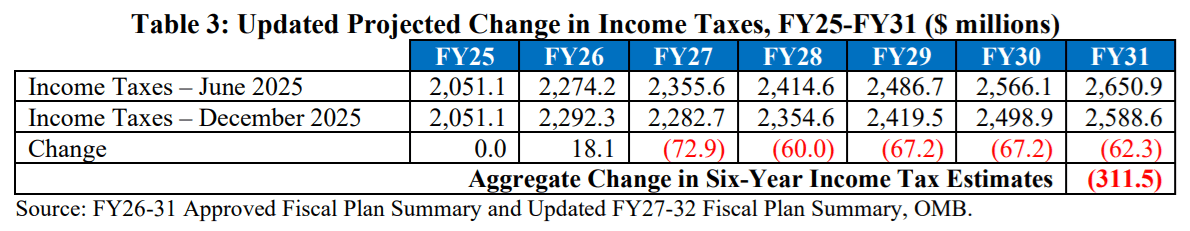

Income tax receipts are written down by $312 million over six years.

Income taxes are usually the second largest source of revenue for the county. The table below shows how estimates of income tax receipts from the June version of the fiscal plan (top row) compare to the newest version of the plan (beneath it).

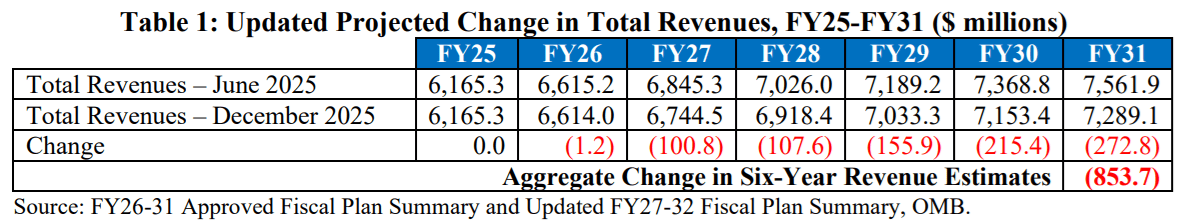

Total revenues are written down by $854 million over six years.

This huge writedown is due almost entirely to falling property and income tax collections and is shown in the table below.

Incidentally, the county is currently not revising its estimates of recordation and transfer tax receipts. Recordation taxes are a major revenue source for school construction and MCPS is making a colossal capital budget request. Does anyone believe that property tax receipts can collapse while recordation taxes – which are tied to sales amounts – remain unscathed?

The county is already overspending its current year’s operating budget.

The county is now estimating that it will overspend its FY26 budget by $30 million. Council staff blames “a higher than anticipated participation rate in the Working Families Income Supplement Program, anticipated overtime expenditures in MCFRS and DOCR exceeding budgeted amounts, and emergency repairs at County facilities performed by DGS.”

Overspending on fire department overtime has been a problem for my entire 19 years of writing about and/or working for county government. The county has never been able to get this under control.

Lower revenues mean lower resources available for spending by county agencies.

This is just basic math, folks. The June fiscal plan estimated resources available for spending by county agencies topping out at $6.873 billion by FY31. The new fiscal plan has written down the FY31 estimate to $6.607 billion. That means hundreds of millions of dollars less for schools, public safety, parks, social services, the college and more unless economic conditions improve or tax rates are changed.

The county is likely underestimating its financial problems by hundreds of millions of dollars.

The new fiscal plan contains this language referring to the state’s maintenance of effort (MOE) law on school spending. It’s written in MoCo Bureaucratese, a foreign language for most residents outside of the council and executive office buildings. After this quote, I will offer a translation.

*****

The Fiscal Plan assumes maintaining funding for MCPS and MC at the FY27 MOE level (as estimated in the Approved Fiscal Plan), and available resources for County government budgets and M-NCPPC increase by 4.6 percent, compared to the FY26 Approved Budget. As stated above, any one-time resources should be used on one-time expenditures. It also should be noted that this version of the Fiscal Plan does not yet account for potential cost increases for FY27, including annualization of FY26 compensation increases, FY27 compensation adjustments for County employees, increased benefits costs, Maintenance of Effort adjustments due to updated school enrollment estimates, any lapses or elimination of Federal grant funding, and annualization of new programs, among other cost pressures likely to reduce available resources for the FY27 budget. These funding decisions, as well as decisions on the use of surplus reserves, will be considered as part of the County Executive’s recommended budget and will be transmitted to the Council in March.

*****

Translation by Pagnucco: The actual numbers will be much worse for two reasons.

First, the plan assumes something close to level funding for MCPS next year. That is absolutely not going to happen. The county exceeded the state’s required minimum spending for MCPS by $86 million in FY23, $198 million in FY24 and $158 million in FY25. The county executive requested a further $250 million over the state minimum in FY26. (I have not seen the final figure published yet.) The state’s maintenance of effort law for school spending generally sets one year’s per pupil local contribution as the floor for the next year, so these increases tend to compound significantly over time. We don’t know what MCPS will request this year, but it’s insane to believe they would settle for anything close to level funding. Let’s remember, folks – we are entering an election year.

Second, the plan omits compensation increases. Last spring, the council’s approved budget contained compensation increases of $416 million for all agencies, including $94 million for the county government, which amounted to a one-year increase of 9.5%. Believe it or not, that’s not terribly out of line with the last three fiscal years, and these increases compound. And once again, folks – we are entering an election year.

We don’t know the true damage yet.

Council staff wrote this: “It was noted during the FY26 Operating Budget discussions that the County would not receive any data about the potential impacts from the Federal Administration’s policies until later this fall. As of December 2025, the County’s actual tax collections and the publicly available economic data remain inconclusive about when those impacts will be measured.” (The bold font was used by the staff, not me.)

So things could get better or they could worse. How would you place your bet?

Let’s add it up. The county’s two largest revenue sources are both collapsing. MCPS has already made a historically gigantic capital budget request and will be asking for more for its operating budget. Politicians naturally go into Santa Claus mode in election years and many endorsements have yet to be issued. And the resulting budget gaps, especially when accounting for the state school spending minimums and compensation, could reach into nine digits.

The odds of a major tax increase have increased substantially with this report. In fact, there is already a rumor that it will be called “a Trump tax.”

I get it. Blaming Trump for a tax hike is good marketing, and there is no disputing that his tenure is disastrous for the proper functioning of the federal government and the welfare of the region’s economy. (I bet our neighbors will have their own writedowns too.)

But our economic competitiveness problems long predate Trump’s reign as I have previously written and soon will again. And we had three tax increases (impact taxes, recordation taxes and property taxes) back in 2023 when Trump was out of office. Finally, Trump did not force the county to approve a 9.5% one-year compensation increase when federal layoffs were already underway. That’s the equivalent of borrowing money to buy a yacht when your house is being foreclosed.

So yes, folks, you can guess where all this is headed. And whatever they call it – “a Trump tax” or something else – you’re going to pay for it.