By Adam Pagnucco.

With MoCo’s rental housing industry under a nationwide financial boycott, County Executive Marc Elrich and a majority of the Montgomery County Council have signed on to a letter to the General Assembly claiming that “Research consistently shows that rent stabilization laws, including ones with vacancy control, do not stymie development.” Besides being provably wrong, the letter is the last thing we need in the face of an increasingly severe housing shortage.

The letter, which is reprinted at the end of this column, is addressed to the Maryland Senate Judicial Proceedings Committee. The committee is considering legislation by Delegate Jheanelle Wilkins authorizing counties to pass local laws providing for “good cause eviction.” The bill is a top priority of the Montgomery County Renters Alliance, which takes taxpayer money and then advocates for legislation in Rockville and Annapolis. (The current state lobbying disclosure list contains no reference to the Renters Alliance.)

Most of the letter is devoted to a discussion of the intersection between good cause eviction and vacancy control provisions in rent control laws, which subject vacant units to rent restrictions. (Such restrictions sometimes prevent landlords from ever charging market rates for controlled units, one of many disincentives to leasing units under rent control.) But then the letter, signed by many local elected officials including County Executive Marc Elrich and Council Members Natali Fani-Gonzalez, Will Jawando, Sidney Katz, Kristin Mink, Laurie-Anne Sayles and Kate Stewart, asserts that “Research consistently shows that rent stabilization laws, including ones with vacancy control, do not stymie development.” Council Member Evan Glass was the only council member to vote for rent control and not sign the letter.

Where do we begin?

There is a huge body of academic literature illustrating the negative impacts of rent control on housing supply. Surveys of economists in 2012 and 2024 found overwhelming opposition to rent control. When MoCo enacted it in the 1970s, it had to end rent control because thousands of rental units were converted to condos. Takoma Park, which has had rent control for more than 40 years, has not seen a single covered multifamily building constructed after its passage.

More recently, MoCo developers stopped their projects even before the council passed rent control. The Wall Street Journal has revealed that covered apartment building values have collapsed. And national real estate investors have redlined us from project financing. None of this will surprise the council’s central staff, who warned the council that rent control would damage the economy right before they approved it.

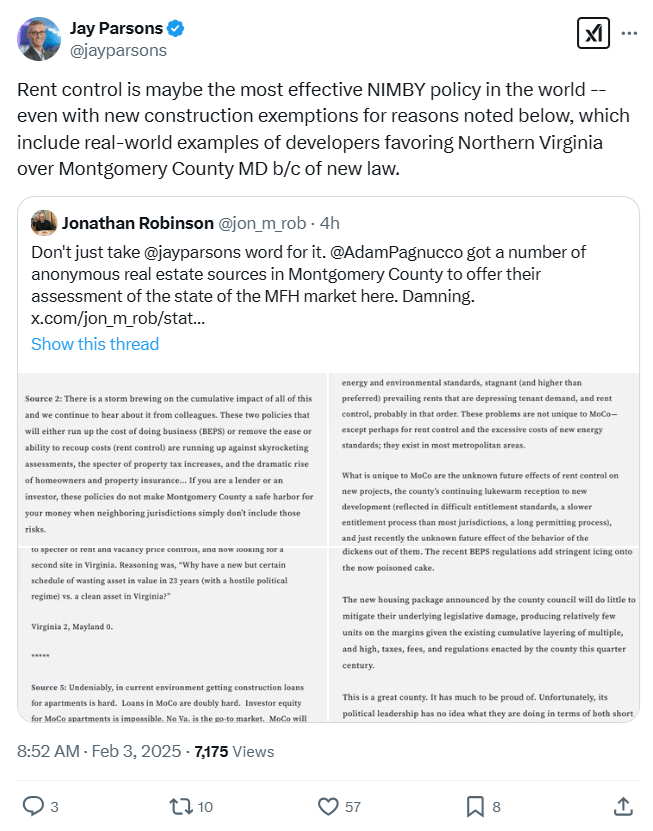

National real estate commentator Jay Parsons describes rent control as “maybe the most effective NIMBY policy in the world.”

As if the above were not enough, the rent controlled housing industry is now undergoing a national financial crisis. The crisis was triggered by a 2019 New York law that cracked down on landlords’ ability to raise rents and remove units from coverage under New York City’s rent control law. Four years later, the Federal Deposit Insurance Corporation (FDIC) took over Signature Bank (NY) after it collapsed. Notably, the bank had three-quarters of its multifamily loans in rent controlled properties. Bloomberg referred to the rent controlled loan package as “toxic waste” after FDIC acquired it.

The Signature Bank collapse attracted the attention of the U.S. Securities and Exchange Commission (SEC). According to a Bisnow article in January:

*****

The Securities and Exchange Commission has sent correspondence within the past year to Dime Community Bancshares, Delhi Bank Corp. and New York Community Bancorp, now known as Flagstar Financial, asking for further information about the financial institutions’ exposure to multifamily properties impacted by New York City’s 2019 rent stabilization laws, according to public records analyzed by Bisnow.

“Inflation [is] coming up, and net operating income is just dwindling and dwindling,” EisnerAmper Director Robert Martinek said. “My guess is that the SEC is aware of this and, with the bank failures, they’re trying to get a hold on any bank with stuff on their balance sheet that’s risky.”

The SEC requests could shed light on the risks that banks carry related to apartment buildings that have plummeted in value due to rising costs and an inability to increase rents as a result of the Housing Stability and Tenant Protection Act of 2019.

*****

Let’s consider the meaning of the above statement referring to “apartment buildings that have plummeted in value due to rising costs and an inability to increase rents.” That has occurred not just in New York City but also in Montgomery County.

And so financial institutions have been sent a message by the SEC: if they have large portfolios in rent controlled buildings, especially in jurisdictions with tough laws like New York City, the agency will pressure them to disclose the risks of those loans to investors. And then investors can sell off their stocks, thereby endangering their solvency. What banks will want to take that risk? The situation is bound to cause banks to avoid loans tied to rent control, thereby cutting off the flow of financing for rent controlled projects (assuming there are any). Also, bear in mind that these inquiries started during the Biden administration. How will a Trump-era SEC view rent control loans?

Given all of the above, especially recent events in the financial industry, how can anyone claim that rent control does not impact housing supply?

With everything going on in MoCo’s rental housing sector, signing this letter was one of the worst things Elrich and the council majority could have done. Because once the national real estate industry sees it – and they will – the red line around our county will become a red wall. The only thing worse than elected officials who make terrible decisions are elected officials who double down and refuse to admit that they were wrong.

The letter with the signature page as of March 11 is reprinted below.