By Adam Pagnucco.

When you raise a tax rate, you get more revenue from it, right?

Not always.

If you want a demonstration of a rate increase and a revenue drop, look no further than Montgomery County’s budget.

Last spring, the county council raised three taxes on real estate: a 4.7% property tax increase, a large increase in recordation taxes on home sales and a big increase in impact taxes on development. (The latter was so huge that the council passed a bill to reduce the size of it.) The council followed these tax hikes by passing rent control. At the time, I asked if the county wanted to kill its real estate industry. But hey, at least we would get more tax money from it, right?

Well, maybe not.

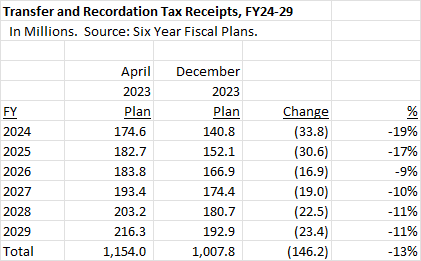

According to the county executive’s six-year fiscal plan from April 2023, which was written before the recordation tax hike, the county was projecting $1.154 billion from FY24 through FY29 in combined recordation and transfer tax receipts. The version of the recordation tax hike approved by the council in May was projected to add $196 million in revenues from FY24 through FY28. But the December 2023 six-year fiscal plan estimated that recordation and transfer taxes would be $1.008 billion over the FY24-29 period, a drop of $146 million. The table below shows the annual changes in estimates between the two fiscal plans.

What happened?

The December 2023 plan explains:

Transfer and Recordation Tax Revenues. Finance estimates that these tax revenues will be $33.8 million less than the FY24 approved budget. This decrease is due to the actual volume of sales being lower than the assumptions in the approved budget. Overall, these decreases reflect a continued weak real estate market. Reductions in these tax revenues will impact resources available for the Capital Improvements Program (CIP).

Of the $33.8 million reduction in FY24, $22.5 million was from transfer taxes and $11.2 million was from recordation taxes. Last spring’s recordation tax hike was projected to add $46.7 million in FY24.

So why is the “actual volume of sales” lower than the county originally thought? The fiscal plan does not say, but here are a few guesses. First, the real estate industry has noted tight inventories of homes for sale in MoCo. Second, rent control has probably damaged the potential sale value of rental properties. (Who wants to pay big money for rent-controlled buildings?) And third, the office building sector is in big trouble. Our county executive would like the state to allow him to raise property taxes even more on commercial properties.

Now total revenues are still up. One of the biggest reasons is that in building its revenue projections, the county assumed “a mild recession” that never happened. That was true in both April 2023 and December 2023. That had the effect of lowballing revenue estimates and creating a “need” for tax hikes that was not real. The county’s projections were so bad that its revenues came in $455 million above estimates for the two years of FY23-24, leading me to question whether last year’s property tax hike was necessary. I get that being conservative on revenue estimates has its virtues, but being off by nearly a half billion dollars is ridiculous.

On the day that the council passed the recordation tax hike, Council Member Gabe Albornoz said, “I support the notion of the need for an enhancement of the recordation tax. I do. But I think this is a really big swing. And I think that this could ultimately end up being de minimis.”

The next time I buy a lottery ticket, I will ask Albornoz to pick the number.

This whole episode illustrates a central truth that is known to economists and business people but escapes many politicians: revenue comes not just from tax rates but also the size of the tax base. If rates are jacked up so high that they cause the tax base to shrink, the result may be revenue declines, not increases. Nothing in the fiscal plans prove that this has actually happened here, but given the county’s predatory behavior on its real estate industry, I think it’s worth asking the question.

Will county leaders learn this lesson? Or will they start pressing the tax button again? We will gain some insight into this when the county executive releases his next recommended operating budget in a day or two.