By Adam Pagnucco.

One of Montgomery County’s best programs is the Working Families Income Supplement, which is what the county calls its earned income tax credit (EITC). The EITC is established in the federal tax code and offsets part of the income taxes paid by low income workers. The State of Maryland matches 50% of the federal EITC and MoCo has matched the state’s EITC for most of the last two decades. MoCo, San Francisco and New York City are the only localities I know of who offer local EITCs.

MoCo’s EITC has an interesting history. It was first proposed by County Executive Doug Duncan in 1999 as an alternative to living wage legislation; both were passed by the county council. It was originally established to provide a 100% match for the state’s EITC, but it was decoupled from the state and reduced during the Great Recession. It was subsequently restored to a 100% match by Bill 8-13, which was lead-sponsored by Council Member Hans Riemer. (Disclosure: I was Riemer’s chief of staff at that time and I busted my hump to get that bill passed!)

Then came the pandemic, which created desperate needs among low income workers who were laid off or had their hours cut. The State of Maryland expanded its EITC and the county matched it. But there was a catch: the county used federal money to do so. Now that federal money is gone and, if County Executive Marc Elrich gets his way, so too will most of the increase to the county’s EITC.

A county council staff packet explains the problem. In order to match the state’s EITC boost, the cost of the county’s EITC increased from $22 million in FY21 to $40 million in FY22 and $49 million in FY23. In both FY22 and FY23, the county tapped $25 million in federal American Rescue Plan money to pay the extra costs. This year, the federal money will disappear, so what does Elrich want to do?

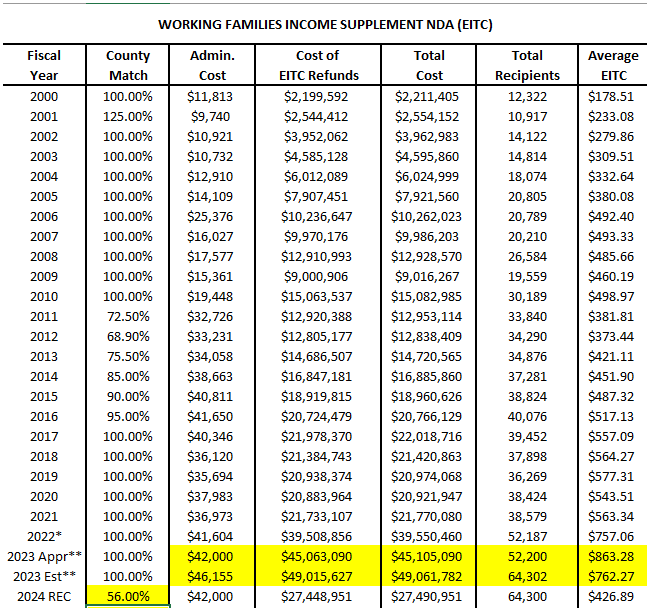

His solution is to replace the $25 million of lost federal money with an extra $7.4 million in county money. The effect of that will be to cut the county’s match of the state’s EITC from 100% to 56%, the lowest match in the history of the county’s EITC. As a result, the size of the average EITC will drop from $762 in FY23 to $427 next year – a cut of 44%.

The table below from the staff packet illustrates the program’s financial history since it was established in 2000.

On the one hand, Elrich can’t control federal money and $25 million is a big hole. On the other hand, the EITC is a proven, long-time anti-poverty program and its expansion during the pandemic may have cut child poverty by 30%. That’s why Governor Wes Moore and the General Assembly just passed legislation to make the state EITC’s pandemic expansion permanent.

Above and beyond that, cutting tax credits for low income workers by 44% while increasing their property taxes by 10% is cruel. How could anyone who favors that combination call themselves a progressive?

I have been writing a lot lately about how the county’s fiscal recklessness is the real cause of Elrich’s huge tax hike proposal. If we had not been adding a couple thousand new positions over the last four years, we might have been able to avoid it. The council must find ways to save money, starting with vacancies and then dealing with soaring fund balances, one-time revenues and restructuring.

But if there is one spending program worth fighting for, it is definitely the EITC. The council should do whatever is fiscally possible to sustain it.