By Adam Pagnucco.

With MoCo’s revenues nose diving, the talk of tax hikes is predictably heating up. Here is one idea making the rounds: let’s just tax rich people. We certainly have a lot of them as anyone driving around Bethesda, Chevy Chase and Potomac can see. Can we do it? Should we do it?

Council Member Will Jawando says yes.

Here is a transcript of what he said at Tuesday’s meeting of the county council when discussing the county’s ruinous new financial projections.

*****

Council Member Will Jawando.

Obviously, every year we have to take the hand we’re dealt. And this cruel and immoral administration is dealing us a really horrible hand. And whether it’s the six thousand plus federal workers who have lost their jobs already here in the county – many of us stood out and watched some of the folks at HHS down the block here scan their ID and not be allowed in to work a few months ago – to what’s happening to our immigrant community, we’re going to have to step up in that context, right? And it’s an uncertain context because, as you said, things are changing each and every day.

Well, one thing that I think it’s important to give the context here is it’s also unprecedented in its cruelty, but also in how the actions of this administration are transferring money from the lowest income to the highest income. The biggest transfer of wealth that has ever occurred was the One Big Ugly Bill that transferred wealth from low income Medicaid recipients, SNAP recipients, folks who are relying on Head Start… to the wealthiest one percent, people making more than a million dollars.

And we have to sit with – we have a lot of millionaires in Montgomery County. In 2017, the last time an assessment I saw was done, there was over 3,200 of them. And I’m glad they’re doing well but we have by far a thousand more than any other place in the state. Five of the richest cities in the state, the top five are all here in Montgomery County. So you have people who are sitting with the benefit of this horrible, cruel administration’s actions through further capital gains, through further reductions in income tax, they are getting – the average millionaire, a hundred thousand dollars, around that, back in federal taxes.

And who’s that coming from? That’s coming from the SNAP recipient. The Medicaid recipient. The student who needs Head Start.

So while we’re going to have to make difficult decisions as we do every year, we’re also going to have make the unprecedented decision of understanding that context at the same time.

Now are we going to be able to supplant what the federal government has taken away and given to the wealthiest among us? No. But we do have to prioritize and plug holes. And we’re going to have to ask, I believe, our community members who have done well to do more to help us fill those holes. I’m just going to be very clear about my view.

*****

What should we make of this?

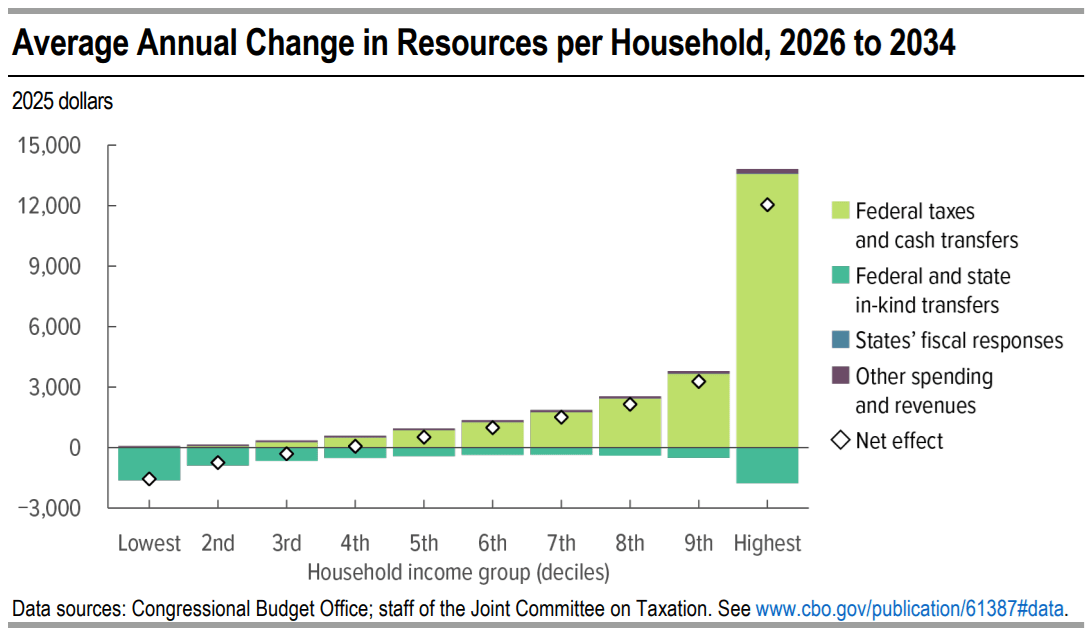

First, Jawando is right about the distributional effects of the federal H.R. 1, which supporters call the One Big Beautiful Bill and opponents call the One Big Ugly Bill. The Congressional Budget Office (CBO) wrote this about the bill:

CBO estimates that if the legislation was enacted, U.S. households, on average, would see an increase in the resources available to them over the 2026–2034 period. The changes would not be evenly distributed among households. The agency estimates that in general, resources would decrease for households toward the bottom of the income distribution, whereas resources would increase for households in the middle and top of the income distribution.

CBO included the chart below showing dollar changes in income by decile, with the wealthiest people getting big payouts and the poorest actually losing money.

So can county government fix this inequity imposed by the federal government? Not really, and that’s because of Maryland’s tax structure.

In Maryland, the counties and Baltimore City are creations of the state. And they may only exercise those powers that are granted to them by the state. That extends to taxation, and the two largest revenue sources available to counties are property taxes and income taxes. Let’s look at them.

Maryland counties have some flexibility in levying property taxes, but generally speaking, they must charge the same rate for all classifications of real property. County Executive Marc Elrich has been crusading for the authority to charge higher rates for commercial property for years, but so far, the state has not allowed it. Jawando testified in favor of a bill allowing differential rates five years ago, so he is aware of this limitation.

Until recently, Maryland counties were only allowed to levy flat income tax rates. However, back in 2021, the state allowed counties to establish income tax brackets. MoCo’s problem was that it already charged the maximum income tax rate allowed by the state (3.2%), so the only way to make its income tax progressive was to create lower-rate, lower income brackets, which would have lost money. Two years ago, Jawando announced his support for raising the maximum allowable county rate to 3.7%, which would have opened the door to a progressive income tax, but the state rejected the idea. Last year, the state increased the maximum county rate to 3.3%, so MoCo could conceivably tax the rich at 3.3% and tax everyone else at 3.2% (or lower). That would likely have a small impact on equity and revenue collections.

That doesn’t mean MoCo has zero options for going after the rich. For example, it charges higher recordation tax rates on homes selling for high values. But that’s peanuts compared to the billions of dollars brought in by property taxes and income taxes.

Now here is what Jawando is wrong about: Maryland’s rich did not get away unscathed with federal tax benefits from the Big Ugly Bill. Last spring, the General Assembly pushed through tax hikes targeting wealthy people by creating new top state income tax rates and a capital gains surcharge. So MoCo’s wealthy are paying more – not so much to the county but to the state. And then through the wealth formulas that drive state aid programs, the state is sending that money disproportionately to lower income but politically powerful jurisdictions like Baltimore City (home of the Senate President) and Prince George’s County (home to the next House Speaker). That’s how the state’s political system is structured, and the Lords of Annapolis aren’t going to change that because a county politician in MoCo is (smartly!) using populist positions to get votes.

Want more? How about levying corporate income taxes, inheritance taxes, estate taxes or other taxes that disproportionately go after rich people? Maryland’s state government does all of those things, but it won’t share that authority with the counties.

MoCo politicians (including Jawando) know all of this, so talk of big county tax increases targeting the wealthy is more about showmanship than policy making.

Even if the state someday lets the counties target the rich, they may be a dwindling resource. Last spring, I authored an eight-part series chronicling Maryland’s loss of taxpayer income to flight, which is mostly driven by wealthy people relocating to Florida and the South. This is facilitated by Maryland’s combined state and county income tax rates that are some of the highest on the East Coast. If your revenue model is based on taxing people who are headed out the door, you are going to have big fiscal problems.

As for Jawando, while he may want to tax the rich, he has long favored broad tax hikes that catch lots of other folks too. He has co-sponsored legislation raising recordation taxes, introduced a charter amendment (along with Council Members Gabe Albornoz and Sidney Katz) making property tax increases easier, advocated for increasing the income tax and voted against a property tax hike only because it was not big enough.

So sure, it’s good politics to talk about taxing the wealthy. But because of how state and county tax regimes are structured, any major new taxes by MoCo are likely to hit the rest of us too.